The escalation of US tariffs on Indian exports by President Donald Trump is putting pressure on India stock market, widening its performance gap with China and threatening its ambitions to become the world’s next growth engine.

India Stock Market Trails China by $6.3 Trillion

India stock market now lags behind China’s by a staggering $6.3 trillion, the widest gap since March.

The MSCI India Index has underperformed its Chinese counterpart by 10 percentage points this quarter.

Heading toward its worst annual performance since 2017, according to Bloomberg.

Trump’s announcement of a 50% tariff on Indian exports—half of which targets purchases of Russian oil—has sparked concern.

Notably, the US has singled out New Delhi for penalties while largely overlooking Beijing, despite China importing significantly more oil from Moscow.

Meanwhile, China awaits a potential extension of its trade truce with the US.

Investor Sentiment Shaken by Trade Tensions

The selective targeting has rattled investors already wary of India’s high valuations and slowing corporate earnings.

In July alone, foreign investors pulled $3 billion from India India stock market—the largest monthly outflow since February.

Goldman Sachs recently forecast continued underperformance for Indian stocks relative to other emerging markets, maintaining a “market weight” stance on India while upgrading its bullish outlook on Chinese equities.

Shifting Investor Focus: From India Back to China

The reversal in investor sentiment highlights the volatility facing Asia’s two largest economies.

Just a few years ago, China was deemed “uninvestable” due to regulatory crackdowns and geopolitical risks, prompting a pivot to India.

Now, India faces its own hurdles—rising trade tensions, declining earnings, and steep valuations—causing investors to reassess.

According to Anna Wu, strategist at VanEck Investments in Sydney, “India has long been a US ally, but escalating trade tensions and Russia’s oil backlash are dampening investor confidence.”

Wu expects Chinese equities to outperform Indian stocks in the coming quarters.

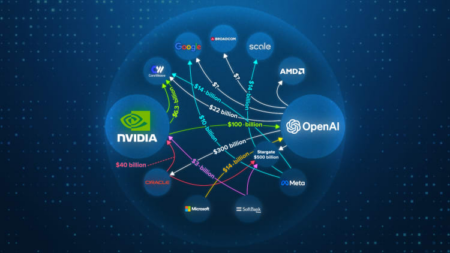

China’s Market Rebounds Amid AI and Policy Support

China’s stock market has gained momentum this year, buoyed by easing trade tensions, pro-growth government policies, and breakthroughs in artificial intelligence, including the success of DeepSeek earlier this year.

Still, India’s long-term economic outlook remains compelling.

Morgan Stanley expects that India stock market will reach new highs in the coming decades, driven by strong population growth, infrastructure development, and a rising share in global GDP.

Domestic Support Shields India Stock Market

Local institutions have invested nearly $50 billion in India stock market, according to Bloomberg data.

These domestic players, along with retail investors, now hold a larger share of the $5.2 trillion market than foreign funds, offering some protection against sharp sell-offs.

China’s Economic Challenges Persist

Despite outperforming expectations, China’s economy still faces headwinds.

UBS has delayed its forecast for a real estate recovery amid weak Q2 sales.

Deflationary pressures and sluggish consumer demand remain concerns.

India’s Industrial Ambitions at Risk

India’s deteriorating trade relations with the U.S. and new tariffs could undermine its efforts to position itself as a manufacturing alternative to China—a key goal for Prime Minister Narendra Modi.

While India grapples with elevated valuations and trade uncertainty, China offers access to booming sectors like AI, clean energy, and biotech at more attractive prices.

The MSCI India Index trades at over 21 times forward earnings, compared to 11.9 times for China’s index.

Chetan Seth, Asia-Pacific equity strategist at Nomura Holdings, notes: “Until trade uncertainty lifts, Indian equities may lose regional allocation priority.

There’s room for further foreign fund outflows.”