Somalia National Stock Exchange was officially established in Mogadishu.

Marking a major milestone in its economic recovery and reintegration into regional and global financial markets.

Operating as a private, self‑regulated entity, Somalia National Stock Exchange will work closely with the Somali Ministry of Finance and Central Bank to ensure a transparent, well-governed market.

Trading to Launch with Stocks & Sukuk in Key Sectors

Trading is expected to go live in early 2026, focusing initially on equities and Islamic‑compliant Sukuk bonds to support infrastructure, telecom, banking, real estate, and energy sectors.

Somalia National Stock Exchange will enable government-backed Sukuk issuance to fund critical infrastructure projects like roads and utilities.

Diaspora Outreach & Regional Integration

To build awareness and trust, NSES plans investor education campaigns and roadshows targeting the Somali diaspora in Turkey, Kenya, the UK, Norway, and the USA.

As a new member of the East African Securities Exchanges Association (EASA), the exchange aims to connect with bourses in Kenya, Tanzania, Rwanda, and Uganda, enabling cross-listing and broader market access.

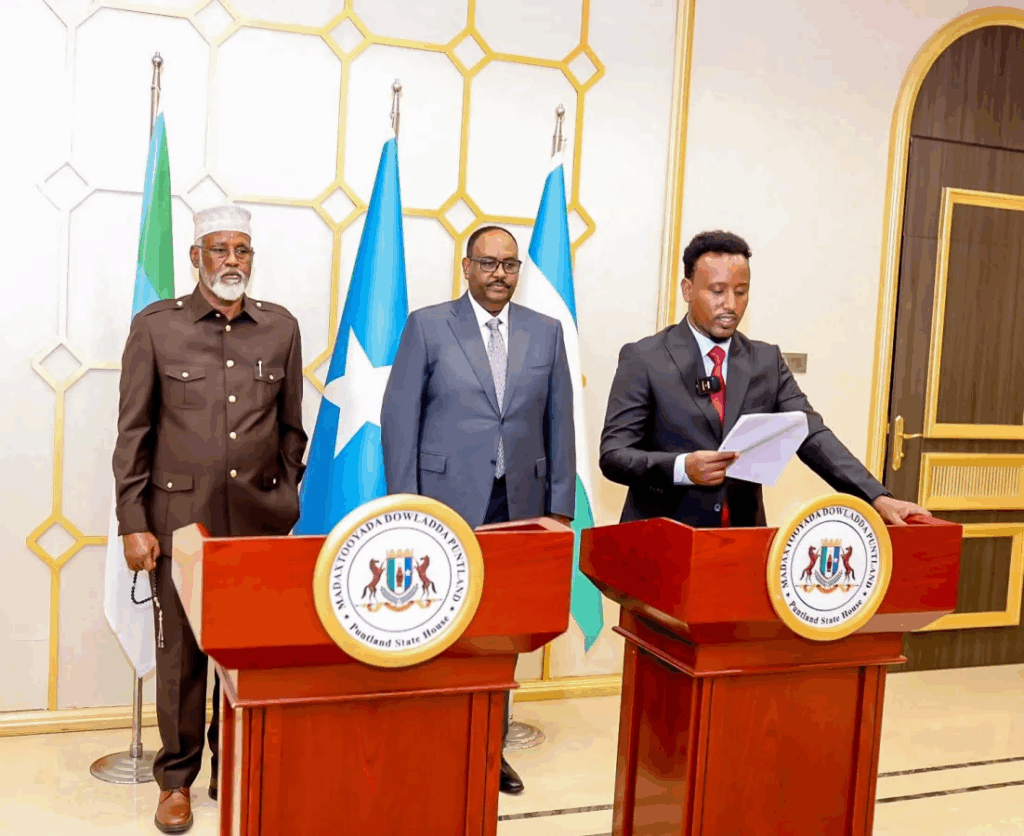

Leadership & Regulatory Support

- Yasin M. Ibar has been appointed as CEO and spokesperson for Somalia National Stock Exchange.

- Ali Yassin Sheikh, Deputy Governor of the Central Bank, pledged technical guidance and policy backing to develop a stable financial market.

What Will Somalia National Stock Exchange Provide to Economy?

- Provides companies—large and small—with new capital‑raising avenues

- Attracts diaspora and foreign investment

- Enhances financial inclusion and formal sector growth

- Aligns with movements in East African capital market integration

- Pioneer in Islamic finance with Sukuk initiatives

Next Milestones to Watch

- Early 2026: Official start of trading operations for both equities and Sukuk

- Cross‑listing deals with regional exchanges

- Sukuk issuances to fund civil projects

- Digital platforms and investor tools to expand participation

Somalia’s exchange launch signals a decisive shift toward formal, regulated capital markets that can attract investment and reduce reliance on informal systems.

As part of the booming East African financial ecosystem—alongside Ethiopia, Kenya, and others—Somalia stands to benefit from increased investor trust and expanding financial infrastructure.

The NSES marks a historic leap for Somalia, ushering in improved economic resilience, diaspora-led investment, and regional financial integration.

With trading set for early 2026, this is a development that both local and global investors should closely monitor.