US stock market closed lower on Tuesday, marking a cautious start to September—a historically weak month for equities.

Investors reacted to fresh trade policy developments and a sharp rise in Treasury yields, triggering profit-taking across major indices.

US Stock Market Major Indexes Retreat Amid Uncertainty

- Dow Jones Industrial Average fell by 249.07 points (−0.55%) to close at 45,295.81

- S&P 500 Index dropped 0.69%, ending at 6,415.54

- Nasdaq Composite declined 0.82%, settling at 21,279.63

The downturn followed a strong August, where the S&P 500 notched five new all-time highs and climbed above 6,500 for the first time.

However, September’s reputation as a volatile month looms large, with the index averaging a 4.2% drop over the past five years.

Profit-Taking Hits Big Tech in US Stock Market

With summer unofficially ending, investors locked in gains from high-performing tech stocks.

Nvidia shares dipped nearly 2%, while Amazon and Apple each lost around 1%. The pullback reflects broader caution ahead of key economic data releases.

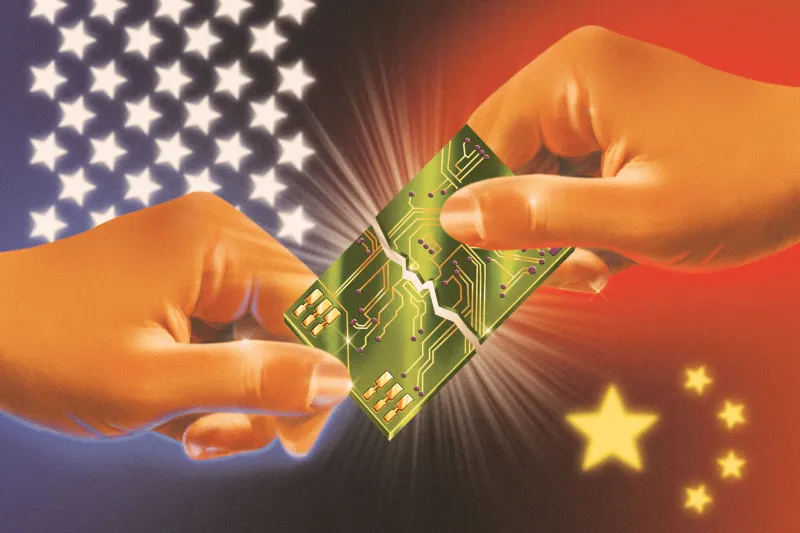

Trade Ruling Sparks Market Jitters

Investor sentiment was shaken by a federal appeals court ruling that deemed most of President Trump’s global tariffs illegal.

The decision, passed in a 7–4 vote, emphasized that only Congress holds the authority to impose broad levies.

Trump criticized the ruling as “Highly Partisan” and plans to appeal to the US Supreme Court.

The potential for tariff refunds has raised concerns about the fiscal impact, adding pressure to an already strained US budget outlook.

Treasury Yields Surge, Adding to US Stock Market Pressure

Bond yields surged at the start of September:

- 10-Year Treasury Yield rose to 4.27%

- 30-Year Treasury Yield climbed above 4.97%

Higher yields are seen as a headwind for equities, especially those trading at elevated valuations.

“A 30-year Treasury of 5% is a headwind, no doubt about it,” said Ross Mayfield, investment strategist at Baird Private Wealth Management.

Eyes on August Jobs Report and Fed Policy

Traders are now focused on Friday’s release of August jobs report, a key indicator that could influence the Federal Reserve’s interest rate decision later this month.

Market analysts expect volatility to persist as investors seek clarity on monetary policy and economic momentum.

Historical Trends Suggest Caution Ahead

According to CFRA Research’s Sam Stovall, years in which the S&P 500 records 20 or more new highs by August often see a September pullback.

“The US stock market may surrender some recent gains in the near term as it awaits new catalysts,” he noted.