The impact of Trump’s tariff, there is new evidence of global pain stemming from President Trump’s trade policy, which single-handedly scrambled the world economy. Why it matters: From China to Switzerland, the economic readjustment to double-digit tariffs has been bumpy. Even with trade deals, the levies imposed on their goods are still well above pre-Trump norms.

THE IMPACT OF TRUMP’S TARIFF: SLOWDOWN OF EXPORTS TO US MARKET

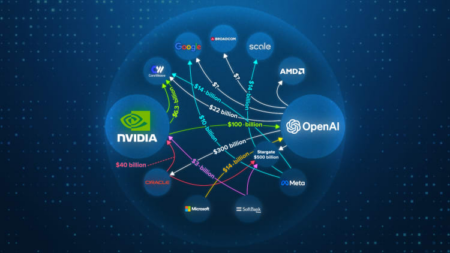

The impact of Trump’s tariff, unlike the U.S., most countries do not have an AI investment boom picking up the slack. Driving the news, Japan’s economy shrank by almost 2% on an annualized basis in the third quarter, the first time activity contracted in more than a year. Switzerland’s GDP in the same period fell by 0.5%, the first quarterly drop since 2023.

READ ALSO:

THE WARNING OF MINISTRY OF PETROLIUM AND MINERAL RESOURCES: ILLEGAL MINING IN SOMALIA

SOMALIA SAYS ZERO ISIS ARRIVALS SINCE THE LAUNCH OF E-VISA: A REGIONAL PUSHBACK

A slowdown in exports to the critical U.S. market was a key drag on the respective economies, as tariffs weighed on demand for their goods. In Japan, shipments of autos plunged after a pickup earlier in the year as many sought to get ahead of tariffs, even as a U.S.. Japan trade deal in July slashed tariffs from 25% to 15%.

The impact of Trump’s tariff, Switzerland’s U.S. exports of watches, chocolate and more plummeted as the near 40% tariff rate imposed by Trump in August took effect. The big picture: That data, released overnight, follows a string of bleak economic readings in China that show the economy is on weaker footing than previously known, even as it ramped up trade tensions with the U.S.

EXPORTS AND INVESTMENTS

The impact of Trump’s tariff, in recent years, strong exports and robust investment have helped make up for slumping demand from Chinese consumers. Now both sides of its economy are struggling in tandem, a recipe for a deeper slowdown. Factory output expanded by roughly 5% last month compared to the same period a year ago, though that is the slowest pace of growth so far this year.

Spending on buildings and equipment contracted by 1.7% in the 10 months ending in October, an unprecedented decline. Between the lines: Exports unexpectedly crashed in October, shrinking more than 1%, the worst since February, when Trump announced an inaugural tariff hike on Chinese goods. Shipments to the U.S. fell 25% compared to a year earlier, but the data indicated the nation is struggling to find other sources of demand for its goods. Reuters reported there were lackluster exports to the EU and other Southeast Asian nations last month, too.

“Chinese exports cannot continue to grow forever, and it’s not only because of the U.S. but because the global economy is slowing,” Natixis economist Alicia Garcia-Herrero told Reuters. What to watch: Recent trade agreements, including with China and Switzerland, have cut tariffs, though they remain notably higher than before Trump took office, a sign that the levies might continue to weigh on the global economy, even if not as much as they did this year.

The impact of Trump’s tariff, China trade truces have fallen apart before and there is a chance that might happen again, even as a struggling economy would seem to give the U.S. an upper hand in negotiations. For example: China appears to already be slow-walking its purchases of U.S. soybeans, a key aspect of the nations’ trade agreement. China promised to buy 12 million metric tons of soybeans this year, “but we’ve not seen any of that,” Todd Main, market development director of the Illinois Soybean Association, told our Axios Chicago colleague Monica Eng.