As the United States’ long summer draws to a close and political and economic life returns to its usual autumn rhythm, investors and analysts are turning their attention to the fate of Donald Trump tariffs, which have become a central theme in the global economic landscape.

A recent report by Bloomberg highlighted three key issues likely to shape the next phase of the trade war.

Have Trump Tariffs Reached Their Peak?

According to Bloomberg, it is still too early to declare that tariffs have hit their peak.

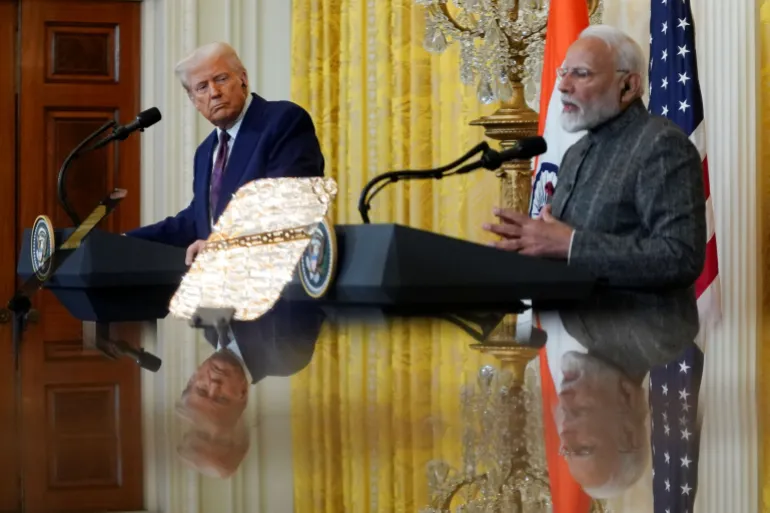

Secondary tariffs of 50% on Indian goods have just taken effect, imposed as a penalty for New Delhi’s continued imports of oil and weapons from Russia.

Strategic sectors such as pharmaceuticals and semiconductors are still awaiting the final tariff rates.

Trump administration has widened its focus with new security investigations targeting wind turbines and imported furniture, while threatening retaliation against any country imposing digital taxes on U.S. companies.

Some of these tariffs also face legal challenges that may reach the Supreme Court.

U.S.–China Economic Relations: A Fragile Truce

The report notes that relations between the U.S. and China appear to be entering a phase akin to an “economic cold war,” with constant tension and the potential for escalation at any time.

Treasury Secretary Scott Besant recently said he was “satisfied” with the state of tariffs and talks with Beijing, though the current cease-fire remains fragile.

Trump hinted at the possibility of visiting China before the end of 2025 or early 2026, signaling a willingness to keep dialogue open.

At the same time, he stressed that the U.S. could impose tariffs of up to 200%, effectively halting trade with China — a move he suggested would also be acceptable.

Domestic Economic Impact of Trump Tariffs

Among the most serious concerns highlighted by Bloomberg are rising inflation and slower economic growth triggered by Trump tariffs.

Federal Reserve Chair Jerome Powell recently warned that tariffs have dampened consumer spending, weighed on the labor market, and reignited inflationary pressures.

Data from the first half of 2025 showed growth at only half the pace of the same period in 2024.

One‑Million‑Person Drop in Migration

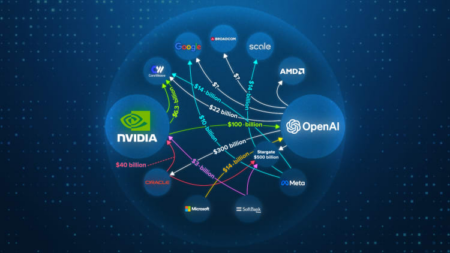

Goldman Sachs figures revealed that while a weaker dollar boosted S&P 500 company revenues by 4.8% year‑over‑year, constant-currency growth was just 2.7%, with medium‑ and small‑cap companies seeing declines.

The report also pointed to a one‑million‑person drop in migration — the largest decline since the 1960s — threatening labor supply and consumer demand, particularly in soybean farming, where trade retaliation has led to lost export markets.

Autumn Outlook: Uncertainty and Global Tensions

The coming autumn could be decisive for the trajectory of the U.S. trade war, especially amid rising tensions with India and Brazil, and the possibility that BRICS nations may speed up efforts to reduce dependence on the U.S.

Uncertainty also surrounds Chinese goods that no longer make their way into American ports.