The wage gap between America’s lowest-paid and highest-paid workers has reached its widest point on record, underscoring the deepening divide in the US labor market.

According to a new analysis by ADP Chief Economist Nela Richardson, the highest-income earners now make more than five times what their low-wage counterparts earn annually — a disparity that continues to grow despite recent economic resilience.

Wage Gap Expands to 5.3 Times

Richardson’s data show that in August 2023, top earners made 4.9 times as much as the lowest-income workers.

By August 2024, the gap had risen to five times, and in August 2025 it reached nearly 5.3 times, meaning the highest earners are now taking home almost 530% more income than those at the bottom of the pay scale.

This accelerating inequality highlights how wage growth for low-income employees has slowed sharply since the pandemic, while high-income earners continue to enjoy steady gains.

The result is a labor market recovery that looks very different depending on where workers fall on the income ladder.

A K-Shaped Economy Creates Divergent Realities

Economists describe today’s economy as “K-shaped,” where affluent households power consumption and GDP growth while lower-income families struggle with higher prices, weaker job prospects and depleted savings.

Bank of America Institute data show that credit and debit card spending by low-income households rose just 0.3% in August compared to a year earlier — the smallest increase since records began in 2016.

In contrast, higher-income households maintained strong spending levels, fueling overall economic growth despite the uneven recovery.

“The growth in income inequality has created a structure in which the privileged few can power the entire GDP while the majority experience a very different economic universe,” said Aaron Klein, senior fellow in economic studies at the Brookings Institution.

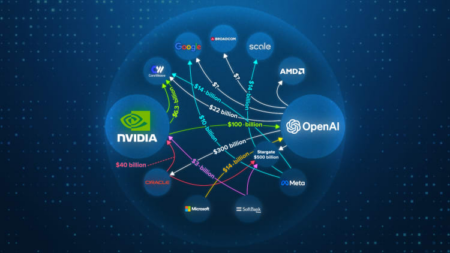

Wealth Concentration Amplified by AI-Driven Stock Rally

The wage gap is being amplified by a parallel wealth gap.

An AI-fueled stock market rally has disproportionately benefited the wealthiest Americans, who hold most of the equity market.

Oxford Economics reports that the richest 1% of US households control about 40% of all equities, while nearly 50% is held by the next 19% of earners.

This extreme concentration of financial assets makes the economy more sensitive to swings in stock prices, as the spending power and confidence of high-income Americans increasingly influence overall growth.

Outlook: Older, Wealthier Consumers Driving Growth

Oxford Economics analysis also highlights that while overall US consumer spending remains relatively healthy, the outlook varies sharply by income and age.

“Younger, less affluent households face ongoing challenges, while older, wealthier consumers will drive overall spending growth, making it more vulnerable to equity and house price shocks,” the firm noted.

Even as consumer sentiment slipped across most income groups this month, it remained steady among Americans with larger stock holdings, according to the University of Michigan’s consumer sentiment survey.

Economists Warn of Uneven Recovery

Michael Pearce, deputy chief US economist at Oxford Economics, emphasized that when analysts say “the economy is holding up,” they are often referring to the spending habits of the highest earners.

This uneven reality raises questions about the sustainability of growth if lower-income households continue to fall behind.

Calls for Policy Responses to Narrow the Divide

Experts suggest that policymakers may need to consider targeted measures to support wage growth at the lower end of the scale, such as enhanced worker training, stronger labor protections and tax incentives for equitable pay.

Without such interventions, the US economy risks becoming increasingly reliant on a small segment of wealthy consumers — making it more vulnerable to market shocks and less inclusive overall.

Source: Yahoo Finance